Markets Eye Cautious Open as European and U.S. Futures Waver on Tariffs and Earnings Jitters

European and U.S. stock futures are mixed this morning as traders navigate a cautious path between recent gains and growing headwinds. European bourses had just delivered five straight sessions of gains, yet futures for the DAX, CAC 40, and FTSE 100 are pausing, suggesting a soft open after the streak. In the United States, futures on the S&P 500 and the Nasdaq-100 point toward a gentler start, signaling a market pause rather than a continuation of the recent buoyant run. The mood is decidedly cautious as investors weigh the potential broader impact of proposed U.S. tariffs, which could rekindle trade tensions at a moment when the global economy remains delicate. A heavy week of earnings releases looms, adding another layer of scrutiny as traders assess corporate resilience against the backdrop of external risks.

Market Snapshot and the Current Risk-Off Tone

Markets are exhibiting a blended tone, reflecting the tug of war between positive earnings surprises in some sectors and the risk of policy shifts that could disrupt global growth. The early mix in stock futures underscores a more guarded stance among investors: the possibility of further volatility if tariff proposals translate into tangible actions or if trade discussions stall. On one hand, several European indices have demonstrated resilience year-to-date, supported by a broad risk-off rotation into defensives in periods of heightened uncertainty. On the other hand, the renewed emphasis on tariffs and trade frictions injects a fresh source of cost pressures into supply chains that are already navigating fluctuating input costs and shifting demand patterns.

This environment favors traders who prioritize risk management, diversify across geographies, and monitor earnings guidance with greater scrutiny. In the current setup, the market is not signaling outright bearishness, but it is clearly resisting the kind of exuberance that would push equities higher without clearer visibility on policy direction and macro momentum. The tension is evident across sectors: Europe’s industrials and tech-heavy U.S. names both feel the impact of growth uncertainties, while more defensive segments—such as consumer staples and utilities—have shown relative strength as investors seek ballast in uncertain times. These dynamics are shaping an opening refrain for the session: cautiously constructive with a clear emphasis on risk controls and selective positioning.

Tariffs, Trade Policy, and the Earnings Outlook

Tariffs as a Persistent Market Constraint

The central narrative driving today’s sentiment revolves around U.S. tariff policies and their potential to reintroduce protectionist pressures into global trade. The possibility that tariffs could be expanded or applied to more partners adds a layer of cost escalation that touches multiple industries and geographies. Tariffs tend to elevate production and logistics costs across supply chains, creating a drag on corporate margins at a time when companies are already negotiating input cost volatility and shifting consumer spending patterns. Even as some markets may have enjoyed earlier improvements in trade flows or supply chain efficiency, the re-emergence of tariff talk raises questions about sustained earnings visibility and the durability of year-to-date gains.

In Europe, the reaction has been particularly nuanced. The Stoxx 600’s year-to-date strength has been notable, but protectionist rhetoric—whether anticipated or actualized—could blunt the rebound. The prospect of tariffs acts as a headwind to investor confidence because it introduces a tangible external risk that earnings guidance must absorb. In sectors that rely heavily on cross-border trade or imported components, the cost pressures can compress margins or force pricing adjustments. The challenge for investors is to distinguish between temporary supply-chain disruptions and longer-term structural shifts that could alter the competitive landscape for multinational companies.

Earnings and Margin Implications

The ongoing earnings season adds another layer of complexity. While some sectors have delivered stronger-than-expected results in Q1, the tone of company guidance has shifted toward caution. Guidance is increasingly colored by uncertainties around future consumer demand and higher input costs, even when topline results have beaten expectations. Investors are parsing whether earnings resilience can be sustained in an environment where tariff risks, exchange-rate fluctuations, and raw material costs could erode profitability.

In the United States, the deluge of economic data today—such as consumer confidence surveys and labor-market indicators—functions as a wild card that can tilt sentiment quickly. A weaker consumer confidence reading or a softer JOLTS job openings report could reinforce concerns that the economy is more vulnerable than equity markets have priced in. The risk for equities is that pricing in the growth outlook may become more fragile if confidence and labor-market momentum falter, even if corporate earnings show pockets of strength.

Sector Sensitivity and Regional Dynamics

With Europe’s industrial-focused indices and America’s tech-led benchmarks reacting to similar growth cues, futures across both regions are reflecting the delicate balance between optimism about earnings and the weight of external risks. The market is increasingly sensitive to growth trends, and the current repricing suggests traders are prioritizing alignment with macro signals over the allure of headline earnings beats. This dynamic often benefits defense-oriented sectors that demonstrate steadier cash flows and visible resilience in uncertain environments, while more economically sensitive areas may endure greater volatility as the tariff narrative evolves.

Economic Data, Confidence, and the Labor Market as Market Catalysts

The Data Deluge and its Implications

Investors eye today’s heavy slate of data as a potential catalyst for market direction. In the United States, the CB Consumer Confidence survey and JOLTS job openings data are particularly pivotal because they provide insights into consumer sentiment and the health of the labor market, both of which are critical for understanding demand trends and inflation pressures. Analysts emphasize that any signs of weakening confidence or labor-market softening could amplify fears that the economy is more vulnerable than equity markets currently price in.

The European data calendar will also matter, given Europe’s reliance on industrial output and export demand as a barometer for growth. Markets will parse how incoming data align with the earnings narratives from multinational firms with exposure to global trade. The degree to which data reinforce or diverge from the tariff discourse could shape how investors position themselves in the near term, especially for cyclical sectors that are most exposed to economic momentum.

Commentary from Market Analysts

Market commentary suggests a cautious but attentive posture. A noted analyst at a major brokerage highlighted that the deluge of data, including consumer confidence and job-market indicators, could act as a swing factor for risk appetite. Any early signs of cooling confidence or labor-market softening would provide additional support for those who argue that the economy may be more vulnerable than equities have priced in, potentially curbing the pace of risk-taking and influencing sector rotation toward defensives.

Sector Performance: Defensive Leaders Amid Broader Market Weakness

The Standout Defensive Plays

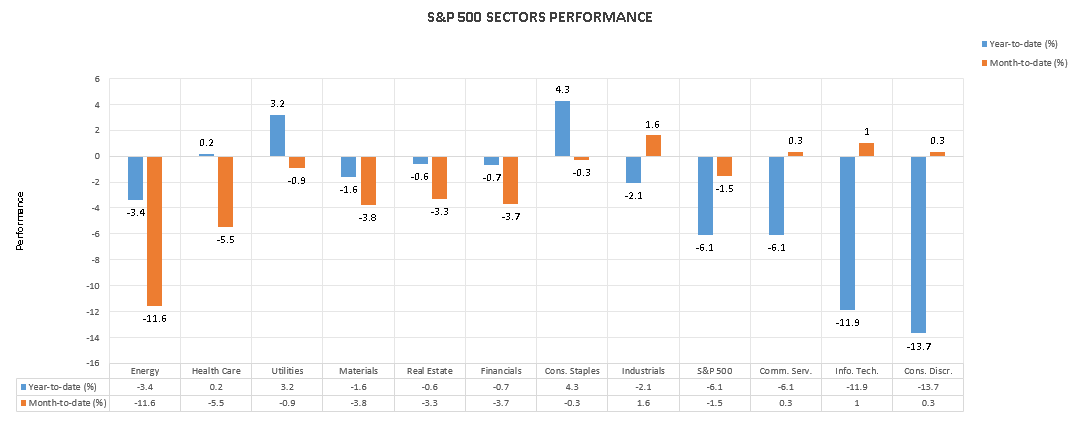

Despite ongoing market volatility, some defensive sectors have outperformed amid broader weakness. Consumer Staples and Utilities have stood out with positive year-to-date gains, underlining investors’ preference for cash-generating, predictable earnings streams when macro uncertainty is high. Consumer Staples, for example, has posted a year-to-date gain around 4.3%, with a modest month-to-date retreat of about 0.3%, highlighting resilience in staples demand and the sector’s defensive tilt. Utilities have also demonstrated strength, up roughly 3.2% year-to-date, even as they faced a slightly negative month-to-date performance of about 0.9%. The defenseward of these sectors reflects investor balance-seeking behavior—prioritizing steady dividends and lower volatility in uncertain times.

Other Sector Dynamics and Notable Movements

Health Care has remained marginally positive year-to-date, around 0.2%, yet it experienced a notable month-to-date decline of about 5.5%, illustrating increased sector volatility amid shifting policy expectations and patent cliffs for some major players. In contrast, more cyclical or growth-oriented sectors have shown more pronounced weakness: Consumer Discretionary has fallen about 13.7% year-to-date, and Information Technology has slipped around 11.9% year-to-date. This divergence underscores a clear rotation away from areas sensitive to economic acceleration toward those perceived as safer or more resilient in uncertain macro conditions.

Implications for Portfolio Positioning

For investors, the sectoral split reinforces a few strategic considerations. Defensive sectors can provide ballast during episodes of tariff-driven volatility and macro uncertainty, while selective exposure to high-quality, cash-generative firms within more cyclical areas can offer a path to capital appreciation when confidence returns. The current environment also underscores the importance of stock selection, focusing on companies with durable pricing power, healthy balance sheets, and diverse geographic exposure to mitigate tariff-related risk.

Geopolitical Tensions, Trade Policy, and Market Sentiment

Trump’s Remarks and Global Trade Implications

Geopolitical developments continue to cast a shadow over market sentiment. Recent remarks from President Trump have raised questions about potential deals with Ukraine, alongside expressed disappointment in Russia. These statements contribute to a broader layer of geopolitical uncertainty that markets must digest in parallel with trade considerations. The evolving policy stance, combined with ongoing conversations about tariffs on Canada and Mexico, has unsettled markets—especially within Europe, where corporate outlooks have already started to reflect anticipated trade disruptions.

The European Position and Corporate Guidance

European companies, already navigating a complex external environment, could adjust their near-term sales outlooks and earnings expectations in response to anticipated shifts in tariff policy and trade routes. In particular, firms with significant exposure to cross-border trade and luxury brands with global distribution networks may need to recalibrate guidance and investment plans to account for potential delays, increased costs, or demand shifts in key markets. The resilience of European indices in recent weeks has been tempered by these geopolitical and policy considerations, making management teams more cautious about forecasting and more selective about capital expenditure plans.

The Data-Driven Outlook

As traders incorporate geopolitical risk into their models, attention turns to upcoming data points and earnings releases. Data on inflation, consumer spending, and labor dynamics will be weighed alongside the tariff narrative to form a holistic view of macro momentum. Investors will be assessing not only whether growth remains intact but whether the conditions for sustained demand are resilient to policy uncertainties and potential trade disruptions. The path forward requires a balanced assessment of earnings momentum, macro indicators, and policy developments.

The Road Ahead: Data, Earnings, and Strategy

Upcoming Economic Indicators to Watch

Looking ahead, investors will be watching a slate of important indicators to gauge inflationary trends and labor-market health. Spain’s Flash CPI will be of interest as a regional read on euro-area inflation dynamics. The S&P/Case-Shiller Home Price Index will provide insights into real estate demand and affordability in the U.S., while JOLTS Job Openings and CB Consumer Confidence will continue to illuminate the strength and confidence of the labor market and consumer sentiment. These data points are critical in assessing the resilience of growth against the backdrop of tariff uncertainty and shifting supply chains.

Earnings Calendar and Sectoral Focus

The earnings calendar remains a central driver for market sentiment. Companies with significant international exposure are under particular scrutiny, as investors evaluate how trade policies and geopolitical developments are affecting performance. The interplay between earnings announcements and macro indicators will shape near-term investor confidence and guide market direction. The combination of earnings results, guidance revisions, and macro data is likely to influence the trajectory of equity markets in the coming weeks, with investors calibrating risk exposure in response to new information.

Market Strategy and Risk Management

In this environment, prudent strategy emphasizes diversification, careful risk budgeting, and a disciplined approach to position sizing. Traders may favor liquidity, selective exposure to defensive names, and a focus on balance-sheet strength and margin resilience. The tariff backdrop argues for a close watch on supply-chain exposure, currency considerations, and the ability of companies to pass through higher costs. Investors should also pay attention to evolving indicators of consumer demand and confidence, as these will influence the sustainability of earnings gains and the durability of any market rally.

Sector and Market Leadership: A Balanced Perspective

A recurring theme in today’s market narrative is the rotation that occurs as investors reassess the risk-reward balance amid tariff discussions and earnings visibility. Defensive sectors have shown relative strength, highlighting a preference for cash flow stability and predictable returns when macro uncertainty is elevated. Yet pockets of resilience in consumer-facing and technology-intensive sectors persist, suggesting that not all growth-oriented equities are being sidelined. The key for investors is to distinguish between temporary headwinds and structural changes that could alter long-term trajectories.

Conclusion

In summary, European and U.S. stock futures reflect a cautious but attentive mood as markets digest tariff risks, earnings momentum, and a data calendar packed with potentially market-moving indicators. The five-session European rally now faces a test as tariff rhetoric and evolving geopolitical developments intersect with corporate guidance and macro data. Investors are balancing the likelihood of continued earnings resilience against the risk that tariff-related costs and trade tensions could erode margins and dampen growth. Defensive sectors offer shelter amid uncertainty, while selective exposure to quality growth remains compelling for those who can identify firms with durable pricing power and healthy balance sheets. As the week unfolds, the blend of upcoming inflation data, labor-market signals, and corporate updates will shape not only the near-term trajectory but also the longer-term risk sentiment that drives market dynamics.