Lutnick: Trump wants a ‘good enough’ EU trade offer to drop 30% tariffs, but what counts as ‘good enough’ remains unclear ahead of the Aug. 1 deadline

A senior U.S. official signaled that the European Union should open its markets to American exports to persuade the administration to roll back reciprocal tariffs, as discussions with Europe grow more critical ahead of an August deadline. The remarks suggest a potential path toward a deal with the EU, though the administration remains cautious, signaling there is about a 50-50 chance that a comprehensive agreement can ultimately be reached. The question now is what constitutes a “good enough” offer from Europe that would compel the president to step away from the 30% tariffs he has threatened to impose, a move that would have wide-ranging implications for transatlantic trade and global markets. As Washington and Brussels brace for discussions, the stakes are high for both sides, with time running short and a complex matrix of issues to resolve.

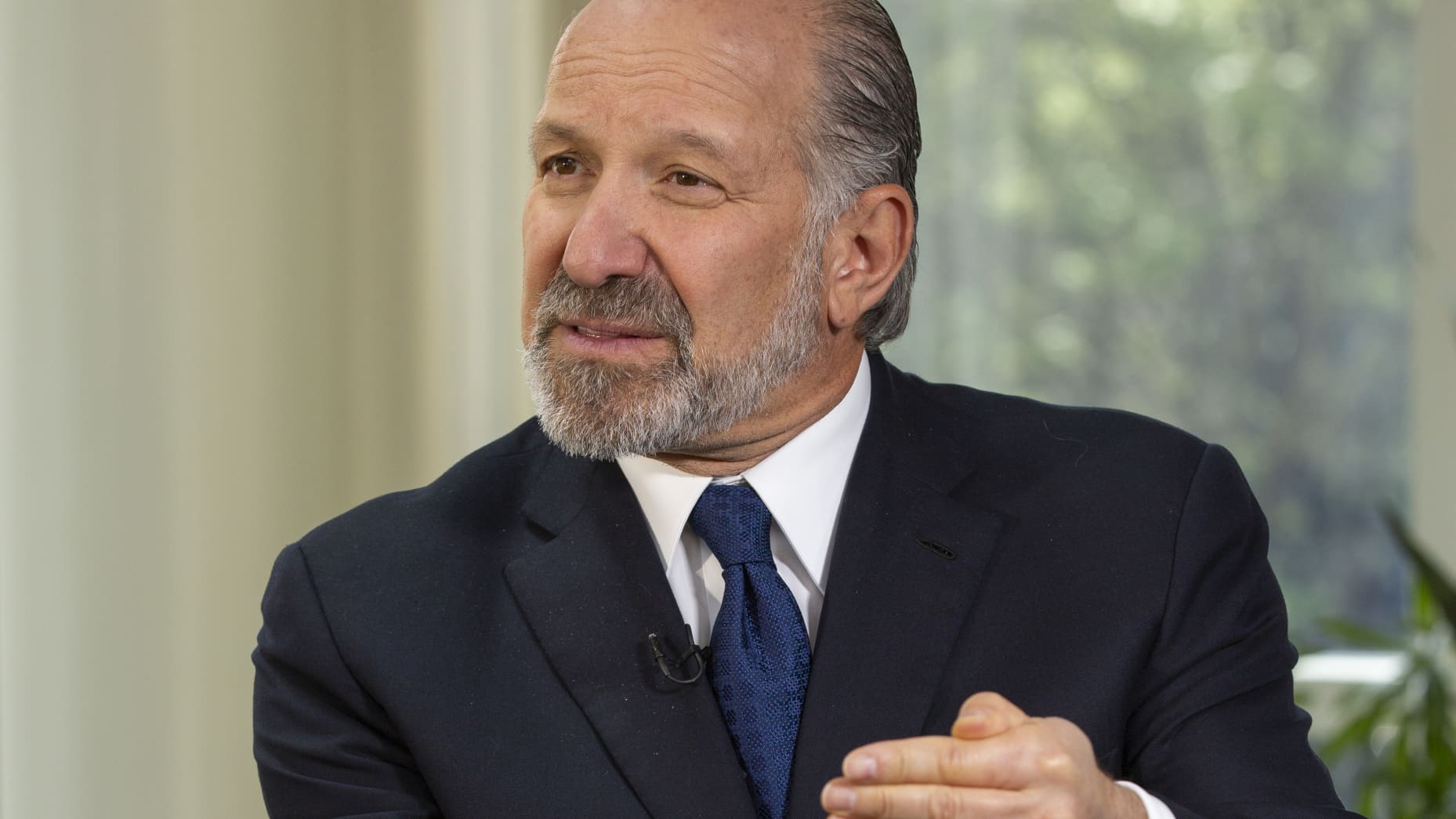

Lutnick’s Call for EU Market Access and Tariff Concessions

Howard Lutnick, serving as the U.S. Secretary of Commerce during a period of intense trade negotiation, publicly articulated a strategic position that ties market access for U.S. goods to the broader question of tariff policy. Speaking on a national platform, he asserted that the European Union should commit to opening its markets to U.S. exports as a central condition to persuade President Donald Trump to reduce reciprocal tariffs on the 27-nation bloc. In his framing, the imperative is not simply a tariff rollback in isolation but a comprehensive package of concessions from Europe that would make the proposed tariff relief politically and economically justifiable.

Lutnick’s comments underscore a crucial negotiation principle: the United States may require tangible improvements in trade access and other favorable terms before stepping back from the tariff leverage it has announced. He framed the issue as a test of value—whether Europe offers a deal that is sufficiently attractive to justify a change in U.S. policy. The emphasis on “reciprocal” tariffs reflects the symmetry the administration seeks in a trade agreement: concessions from the EU in exchange for a meaningful rollback of U.S. tariffs on European goods. The cadence of his remarks also signals a willingness to engage in high-stakes diplomacy in the public domain, leveraging media to set expectations and clarify red lines for both sides.

This public stance sits within a broader negotiation dynamic, where tariff threats loom large and the EU must consider how its own tools and policies might respond to U.S. pressure. Lutnick’s statements suggest that, while a deal remains possible, the bar for a “good enough” offer is set high. The notion of a “good enough” deal invites a careful examination of what terms—beyond tariff reductions—could be embedded in any prospective framework. Europe would need to weigh market access for American products against any concessions it secures to protect its own industries, value chains, and strategic interests. The balancing act is especially delicate given that the EU has a range of instruments at its disposal to respond to external pressure, and any offer would likely need to address broader regulatory and non-tariff barriers in addition to tariff concessions.

In the immediate term, Lutnick’s remarks on Fox News placed the stakes squarely in the public view, signaling that the administration believes a public-facing explanation of the potential deal is part of the leverage and the transparency required to build domestic and international support for a pathway away from costly tariffs. The role of media in this context is to frame the negotiation as a mutual trade-off: Europe gains better access to U.S. markets, and the United States earns tariff relief that could support domestic industries and consumer pricing. The implication is that any final agreement would be evaluated not only on the tariff numbers themselves but on the quality and scope of access, the predictability of the market, and the alignment of regulatory standards with American exporters.

### The Nature of a Framework Instead of a Single Concession

In contemplating what a “good enough” offer would entail, it is essential to consider the structure of a potential framework rather than a stand-alone concession. A framework typically encompasses a bundle of measures: tariff reductions, market access commitments, and perhaps harmonization or alignment of regulatory standards on a set of high-value sectors. It may also include commitments on services, investment rules, and protection for intellectual property, all under a robust enforcement mechanism. Lutnick’s insistence on a meaningful opening of EU markets hints at a broader expectation from the United States that the agreement would deliver tangible benefits across multiple industries, not merely a single-line tariff concession.

From the EU perspective, delivering a comprehensive framework would require careful navigation of domestic political considerations, the interests of member states, and the EU’s own strategic priorities. A successful package would likely need to demonstrate that U.S. market access translates into real opportunities for European exporters and that the terms of the deal do not disproportionately favor one side’s industries at the expense of the other’s economic resilience. The complexity of such negotiations stems from the breadth of sectors involved, including manufacturing, agriculture, services, and technology, each with its own regulatory regime and political sensitivities. The challenge for both sides is to translate the concept of “good enough” into quantifiable, enforceable provisions that can withstand domestic scrutiny.

The public articulation of these goals by Lutnick also reflects a broader strategy to influence investor sentiment and business decisions as negotiations unfold. When a senior official communicates in a way that emphasizes potential gains for American exporters and the objective of tariff relief, it helps set expectations for market participants and industry stakeholders who may be monitoring the talks for signals about future costs and opportunities. The risk, of course, is that overly optimistic statements can create misplaced expectations if the negotiations encounter unforeseen obstacles, while too cautious a stance can dampen momentum. Lutnick’s remarks appear crafted to project a balanced stance: a clear demand for meaningful European concessions, paired with a readiness to consider a tariff-lowering path if such concessions materialize.

The Strategic Role of Public Messaging in Negotiations

The decision to speak publicly on national media platforms underscores the strategic role of messaging in high-stakes trade negotiations. Public commentary can influence how negotiators calibrate their positions, frame their red lines, and judge the likelihood of achieving a settlement. The emphasis on a “good enough” deal signals a threshold that is intentionally high, serving as a communication device to manage expectations within the domestic audience while signaling to the EU that the United States will not settle for a cosmetic agreement. This approach reflects a broader pattern in contemporary trade diplomacy, where public statements are carefully shaped to augment diplomacy on the back channels rather than to close hard deals in a purely confidential setting.

As conversations proceed, stakeholders will watch for a range of indicators beyond the headline statements. These indicators include the scope and specificity of market-access commitments, the level of tariff relief proposed, the duration of any transitional arrangements, and the governance mechanisms that would monitor compliance. The ultimate measure of success would be a framework that creates enduring economic value, reduces friction for cross-border trade, and provides reliable dispute-resolution mechanisms that reduce the risk of backsliding. Lutnick’s focus on a “good enough” threshold thus becomes a bellwether for what the administration regards as a serious, enforceable, and enduring trade agreement rather than a temporary or symbolic gesture.

The Context and Timing of U.S.-EU Trade Talks

The broader context surrounding U.S.-EU trade talks places Lutnick’s remarks within a dynamic environment characterized by looming deadlines, high-stakes tariff policy, and a complex interplay of political leadership on both sides of the Atlantic. The Trump administration has signaled a willingness to impose a 30% tariff unless a favorable agreement is reached, a posture that has placed the European Union under considerable pressure to respond with countermeasures that avoid a straightforward escalation of trade tensions. The upcoming engagement with Ursula von der Leyen, the President of the European Commission, is positioned as a decisive moment for moving from rhetoric to a structured negotiation framework that could translate into a formal agreement.

A central feature of the current negotiation landscape is the August 1 deadline by which the tariff-related policy actions would take effect, providing a tangible timestamp that heightens the urgency on both sides. In the run-up to this deadline, Washington and Brussels are expected to exchange proposals, identify non-negotiable red lines, and explore potential compromises that could form the backbone of a comprehensive trade framework. The presence of a top-tier negotiation dynamic—led by the U.S. with the support or input of key allies and the EU’s executive leadership—signals a coordinated approach that seeks to harness political momentum and public support as the two sides solicit broader consensus for any deal.

### Key Points and Sticking Points

The administration has indicated that negotiations would need to address approximately 20 distinct issues, a multiplicity that underscores the complexity and breadth of possible concessions. The phrasing of “sticking points” highlights the potential friction points where differences could prove difficult to bridge. While the exact topics are not enumerated in Lutnick’s public remarks, the absence of a straightforward solution implies that the talks will involve a mix of tariff-related questions alongside regulatory, regulatory alignment, and non-tariff barriers that affect the ease with which U.S. exporters can access European markets.

From a strategic perspective, the number of issues suggests that the talks will likely unfold in a staged manner, with negotiators prioritizing a few high-impact items to build momentum before tackling more granular or sensitive concerns. The dynamic of multiple topics can also introduce opportunities for sequencing concessions—where early wins in certain areas might create a more conducive atmosphere for broader accord on the remaining issues. The August 1 deadline becomes a driving force, pushing negotiators to identify paths to partial agreements or interim measures that could provide immediate relief while the more extensive framework is negotiated.

Implications of a "Good Enough" Deal and Tariff Projections

One of the central questions raised by Lutnick’s commentary concerns the contours of a tariff-relief package that would be considered compelling enough to prompt the administration to step back from the threat of 30% tariffs. The notion of a “good enough” offer is inherently subjective and dependent on a combination of economic, political, and strategic considerations. For U.S. policymakers, a deal would need to demonstrate measurable gains in market access and strategic protections for key American industries, while maintaining credible enforcement provisions that deter backsliding and protect U.S. interests over the long term. In practice, this could entail a combination of tariff reductions on critical sectors, structural commitments to improve regulatory transparency, and mechanisms that ensure ongoing dialogue and resolution of future disputes.

From Europe’s vantage point, delivering a package that the United States will accept at face value requires balancing the EU’s internal dynamics with the broader goal of preserving the integrity of its single market. While the EU seeks to protect its own industries and regulatory autonomy, it must also consider the benefits of closer integration with the U.S. market, particularly in areas where European companies have competitive strengths. Any framework would need to reassure European stakeholders that concessions granted to the United States do not undermine the EU’s strategic economic position. The practical question remains: what is the minimum level of tariff relief and market access the White House would deem sufficient to abandon the threat of tariffs, and how would those concessions translate into tangible benefits for both sides?

The 30% Tariff Threat and the Prospect of a Framework

The looming 30% tariff scenario has dominated the negotiation narrative, transforming abstract policy debates into a concrete decision on trade policy that would reverberate through supply chains, consumer prices, and industrial competitiveness. If a credible and enforceable framework is achieved, it could unlock a path away from the tariff posture, enabling manufacturers and exporters to recalibrate strategies with greater certainty. The prospect of moving beyond tariffs hinges on a negotiated settlement that satisfies both sides on core objectives. It is not merely a question of tariff numbers but of the sustainability and enforceability of the resulting agreement, the degree to which it reduces friction for cross-border trade, and the resilience of the partnership against future shocks or policy shifts.

Contrasting scenarios exist: a robust agreement could foster a new era of transatlantic commerce, with predictable rules and shared standards that lower transaction costs for exporters and importers alike. On the other hand, a partial or fragile deal could lead to a prolonged period of negotiation, ongoing uncertainties, and potential market volatility as businesses weigh the probability and timing of tariff changes. The stakes are heightened by the EU’s readiness to deploy countermeasures and regulatory tools, including instruments designed to counter coercion, should the tariff landscape shift. In this sense, the negotiations are not only about tariff rates but about the broader architecture of trade cooperation between the world’s two largest economic blocs.

The Role of the Anti-Coercion Instrument and Trade Levers

A notable element in the EU’s potential response toolkit is the Anti-Coercion Instrument, a mechanism that signals Brussels’ readiness to counter coercive trade dynamics. This instrument has been described in discussions as a critical tool for safeguarding European interests when confronted with external pressure that seeks to distort markets or protect strategic sectors. The possibility that Europe might deploy such a measure adds another layer of complexity to the negotiations. It raises questions about how the instrument could be calibrated to minimize unintended consequences for U.S. exporters and global supply chains while providing a credible deterrent against aggressive tariff policy.

The rhetoric surrounding the EU’s anticipated use of countermeasures—often characterized in policy circles as a form of “trade bazooka”—reflects the seriousness with which Brussels views the potential tariff threat. Such countermeasures could take the form of targeted tariffs, sanctions, or other permit-based or regulatory actions designed to reestablish a balance in trade relations. While Lutnick’s remarks focus on a potential market-opening deal, the EU’s consideration of robust responses demonstrates that the resolution of these negotiations hinges on both sides’ willingness to accept meaningful constraints on unilateral policy choices in exchange for mutual benefits. The interplay between a potential framework and Europe’s readiness to deploy countermeasures will likely shape the negotiating posture in the days leading up to the August deadline and beyond.

Economic and Market Impacts of Negotiation Dynamics

The ongoing dialogue between the United States and the European Union, set against the backdrop of tariff threats and market-access debates, is having tangible implications for the global economy and financial markets. Traders, investors, and industry players watch carefully for signs of movement toward a formal agreement or, alternatively, a hardened stance that could translate into renewed volatility and price adjustments across commodities, equities, and currencies linked to trade-sensitive sectors. The public statements by Lutnick and the anticipated conversations with Ursula von der Leyen add layers of forward-looking guidance for corporate decision-makers who must navigate the risk-reward calculus of cross-border trade.

From a macroeconomic perspective, the potential resolution of tariff tensions could influence the direction of supply chains, investment inflows, and long-run competitiveness in both regions. If a credible framework is reached, it may reduce uncertainty and encourage businesses to expand operations, access new markets, and optimize production networks with greater confidence. Conversely, if the talks falter or yield only incremental gains, the risk of continued tariff-related disruption remains, potentially elevating costs for manufacturers and consumers who rely on a steady stream of imported goods from Europe. The anticipation of a decision by August 1 could also lead to near-term market adjustments as traders position themselves in expectation of a policy shift, whether that shift is toward tariff relief or continued protectionist measures.

Sectoral Impacts and Real-World Implications

The potential outcomes of these negotiations are likely to produce varying effects across sectors. Industries with significant exposure to European markets, such as those that rely on seamless access to EU distribution channels, could see improved margins and reduced compliance costs if market access improves. In contrast, sectors that are sensitive to regulatory alignment or that rely on complex supply chains spanning the Atlantic may experience adjustment costs as standards are harmonized or as tariffs are modified. Even within the same sector, firms with diversified supply chains could be affected differently, depending on their exposure to European import and export flows.

Small and medium-sized enterprises (SMEs), which often lack the scale to absorb sudden tariff changes, could be disproportionately affected by any abrupt policy shift. This dynamic underscores the importance of a negotiated framework that provides predictability and a clear rulebook for cross-border trade. Policymakers will need to balance broader macroeconomic objectives with the practical realities of how businesses, particularly smaller players, navigate tariff regimes, compliance costs, and the administrative burden of adjusting to new market access terms. Lutnick’s emphasis on a “good enough” deal is, in this sense, not only a political stance but a signal to the private sector about the expected pace and nature of any forthcoming policy changes.

The Road Ahead and the August 1 Milestone

With the August 1 deadline looming, both sides face an intensifying schedule of discussions, technical exchanges, and preliminary red-line negotiations. The prospect of a meeting between the U.S. administration and EU leadership—embodied by Trump and Ursula von der Leyen—places a premium on achieving clarity about what is essential, what is negotiable, and what would constitute a durable framework that can withstand political and economic pressures. The next phase will likely involve detailed proposals, counterpart analyses, and the identification of areas where symbolic concessions might stand in for more substantial long-term benefits, while preserving the core objective of meaningful tariff relief and improved market access.

As stakeholders monitor the diplomatic process, the critical questions remain: Will Europe be able to present a credible package that justifies stepping back from the tariff threat? Will the United States be prepared to lift or reduce tariffs in exchange for tangible access gains and regulatory commitments? And how will the EU’s Anti-Coercion Instrument be reflected in any final agreement or, alternatively, in an established enforcement framework that reduces the likelihood of future coercion? The answers will shape not only the immediate trade relationship but also the broader trajectory of transatlantic economic collaboration in an era of evolving geopolitical considerations and shifting global trade patterns.

Public Messaging, Leadership, and Strategic Framing

The strategic framing of these negotiations is heavily influenced by the public messaging from U.S. leadership and top business officials who seek to influence the narrative around tariffs and trade access. Lutnick’s public articulation of a demand for a “good enough” EU offer reflects an approach that aims to align executive policy with commercial realities faced by American exporters and manufacturers. The use of a prominent media platform to convey this position underscores the importance of clear communication with the public and the business community, ensuring that expectations are calibrated and that policy options remain visible and comprehensible to a broad audience. This approach can help sustain political support for trade negotiations, particularly when the public understands that a deal is not solely about tariffs but about a broader framework of market access and regulatory cooperation.

The Interplay Between Domestic Politics and International Negotiations

Domestic political considerations inevitably shape the tone and potential outcomes of international trade talks. Leaders and policymakers must balance the imperative to defend strategic industries, manage consumer prices, and maintain geopolitical credibility with the need to secure a durable, enforceable agreement that can endure political shifts within each country. Lutnick’s comments reflect a calculated effort to present a principled stance on market access and tariff relief, while avoiding commitments that would be politically perilous if the negotiations fail to deliver comprehensive concessions. This dynamic highlights how international diplomacy is increasingly mediated by domestic audiences, media narratives, and the perceived legitimacy of policy choices in the eyes of voters and industries.

The Negotiation Timeline and Practical Considerations

Beyond the public rhetoric, the practical elements of the negotiation timeline will determine how the U.S. and EU approach the August 1 deadline. Negotiators will need to translate broad objectives into precise, text-ready provisions, including tariff schedules, sector-specific market-access commitments, and enforcement mechanisms. The complexity of alignment across diverse regulatory regimes will require careful drafting, intergovernmental coordination, and potentially transitional arrangements to accommodate existing commercial contracts and investments. The outcome will depend on the ability of both sides to demonstrate a credible pathway from negotiation to implementation, ensuring that the agreed terms are actionable, transparent, and capable of surviving the political processes in both the United States and the European Union.

The Stakes for Global Trade Policy

The U.S.-EU trade talks do not occur in isolation. They sit at the intersection of a broader shift in global trade governance, where major economies are recalibrating their relationships in response to shifting geopolitical dynamics, protectionist pressures, and evolving supply chain configurations. The prospective framework between the United States and the European Union could set a precedent for how large trading partnerships address tariff disputes in the future, potentially influencing other regions and the architecture of global trade agreements. The negotiations also speak to questions of strategic cooperation, economic resilience, and the capacity of liberal trade regimes to adapt to new economic realities while preserving openness and dynamism across markets.

Timeline, Opportunities, and What to Watch For Next

As negotiations intensify, observers should keep a close eye on several critical indicators that will signal the direction and potential success of the talks. First, any formal proposals or text drafts released by either side will be a telling signal about the scope and depth of concessions being contemplated. Second, statements from both U.S. and EU leaders, including the White House and the European Commission, will help gauge whether a viable framework is emerging or if tensions are hardening. Third, the response from market participants—business associations, trade groups, and investors—will reflect confidence or concern regarding the feasibility of a resolution before the August 1 deadline.

In the weeks leading up to August 1, the public narrative will continue to center on the balance between tariff relief and market access. If a “good enough” package appears on the horizon, expect a flurry of activity aimed at translating broad commitments into concrete, enforceable provisions. This would involve detailed tariff schedules, harmonization of regulatory standards where feasible, and clear dispute-resolution processes designed to minimize the risk of backsliding. Conversely, if negotiations stall or encounter insurmountable divisions, the risk of tariff imposition will remain a live policy option, with market volatility likely reflecting the ongoing uncertainty of the outcome.

The Crucial Questions to Answer Moving Forward

- What specific sectors and products would benefit most from increased U.S. market access under any potential framework?

- How would the EU’s Anti-Coercion Instrument be operationalized within a broader trade agreement to deter future coercive actions?

- What enforcement mechanisms would ensure that both sides adhere to the commitments, and how would disputes be resolved to prevent policy reversals?

- How will the timeline be managed to provide transitional relief to industries affected by the policy shift, if any?

Conclusion

In a high-stakes moment for transatlantic trade, Commerce Secretary Howard Lutnick underscored a strategic demand: the European Union should open its markets to U.S. exports to persuade President Trump to reduce reciprocal tariffs on the EU’s 27 member nations. He framed the issue around a potentially favorable deal that could justify stepping away from a 30% tariff regime, while acknowledging that the likelihood of finally achieving an agreement remains around even odds. The administration’s push comes as talks with the European Commission’s leadership, led by Ursula von der Leyen, loom ahead of the August 1 deadline when tariffs could take effect. The negotiations are characterized by roughly 20 potential sticking points, raising questions about what would constitute a “good enough” deal and how such an agreement could be structured to deliver tangible benefits across sectors.

The EU, meanwhile, has signaled its readiness to deploy countermeasures, including the Anti-Coercion Instrument, should tariff pressure persist, a move that has been described in policy circles as a formidable “trade bazooka.” This possibility adds a layer of strategic calculation for both sides: Europe seeks to protect its interests and maintain leverage, while the United States aims to secure a framework that reduces trade friction and promotes steady, measurable gains in market access. The public dimension of Lutnick’s remarks reflects a broader strategy of aligning political messaging with commercial objectives, signaling that any settlement would hinge on credible, enforceable terms that can stand up to domestic scrutiny and international scrutiny alike.

As the August 1 deadline approaches, stakeholders across industries will be watching for concrete developments, textual proposals, and the degree to which negotiations can translate into a durable, mutually beneficial framework. The outcome will have far-reaching implications for tariff policy, cross-border commerce, and the broader architecture of U.S.-EU economic cooperation. The ultimate measure of success will be not only the elimination or reduction of tariffs but the establishment of a stable, predictable, and enforceable regime that fosters long-term growth and resilience for both economies in an increasingly interconnected global marketplace.