Harvesting Bitcoin Volatility for Income: A Trader’s Covered-Call Strategy on BTC ETFs

Bitcoin sits on a growing class of financial instruments that transform volatility into repeatable income. When you own an asset that can be rented, you unlock a steady revenue stream rather than watching value swing without any cash flow. In today’s Bitcoin market, the opportunity to rent out exposure through exchange-traded funds (ETFs) and to capitalize on option premiums is becoming a central theme for sophisticated retail traders and institutions alike. This piece breaks down how the Bitcoin ETF and option landscape has evolved, how options on these ETFs work, and how a disciplined covered-call strategy can turn volatility into durable cash flow—without surrendering long-term exposure to the asset itself.

The Bitcoin ETF Landscape: Evolution to 2025 and What It Means for Traders

To understand today’s opportunity, it helps to map the landscape of Bitcoin ETFs and the progression of related derivatives. As of June 2025, the U.S. Securities and Exchange Commission (SEC) has approved eleven spot Bitcoin ETFs. These funds are designed to hold actual Bitcoin as their underlying asset rather than chasing Bitcoin futures or synthetic exposure. Among the most prominent entrants are BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s FBTC, Grayscale’s GBTC, ARKB, BITB, EZBC, HODL, BRRR, BTCW, and a handful of other similar products. All of these spot ETFs hit the market in a relatively concentrated window in early 2024, marking a milestone in the maturation of Bitcoin as a mainstream investment vehicle. The presence of numerous spot ETFs creates a broader ecosystem for liquidity, competition on expense ratios, and a more robust base for options trading.

Before this wave of spot ETFs, the market saw a different first stage: Bitcoin futures ETFs. Beginning in October 2021, the SEC greenlit the first wave of futures-based Bitcoin ETFs—products from issuers such as ProShares, Valkyrie, and VanEck that track Bitcoin futures contracts rather than the spot price of Bitcoin itself. These funds provided a gateway into Bitcoin exposure with regulated structures and familiar ETF mechanics, but their underlying assets were futures rather than the spot asset. The shift from futures to spot ETFs represents a fundamental change in how traders can access true Bitcoin ownership through the ETF wrapper, with the potential for more direct exposure and different tax, tracking, and liquidity dynamics.

Another major milestone occurred on October 18, 2024: options on spot Bitcoin ETFs received formal approval and began listing on U.S. exchanges. The ability to trade listed options on spot Bitcoin ETFs introduces a different dimension to the investment equation. It enables traders to craft strategies that capitalize on volatility, time decay, and directional expectations without requiring physical Bitcoin custody. The simple equation that underpins much of this activity is: spot Bitcoin ETFs + options = a robust platform where volatility and opportunity converge.

Not all ETFs offer options, however. The landscape shows a clear distinction between spot ETFs and futures-based ETFs when it comes to options availability. Here is a succinct snapshot of the most notable examples:

-

Spot Bitcoin ETFs with Listed Options (these funds hold actual Bitcoin as the underlying asset):

- iShares Bitcoin Trust (IBIT) — BlackRock

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- Bitwise Bitcoin ETF (BITB)

- VanEck Bitcoin Trust (HODL)

- ARK 21Shares Bitcoin ETF (ARKB)

-

Futures-Based Bitcoin ETFs with Options:

- ProShares Bitcoin Strategy ETF (BITO) — this was the first Bitcoin futures ETF and remains highly liquid

- VanEck Bitcoin Strategy ETF (XBTF) — options exist but are more limited in liquidity; investors should verify broker availability

The presence of options on these funds changes the risk-and-reward profile for Bitcoin exposure. It enables strategies that can generate income in flat or volatile markets, while still preserving fundamental exposure to Bitcoin’s price path. For traders who want to calibrate their risk appetite, the combination of spot ETFs with options, plus a subset of futures-based ETFs with options, creates a spectrum of possibilities for capital deployment and risk management.

The broader takeaway is clarity: the Bitcoin ETF ecosystem has matured to the point where actual Bitcoin-backed exposure is widely accessible, and the derivatives layer—particularly listed options—is now a central feature. This creates a productive environment for those who want to exploit volatility, diversify strategies, and implement disciplined cash-flow generation without needing to Time Every Market Move or guess the precise moment of a breakout.

Why Spot ETFs Matter More Than Theoretically

Spot ETFs are attractive not only because they track the actual Bitcoin price but also because they align more closely with traditional equity-derivative frameworks. They typically offer more transparent tracking, more predictable cash flows (in terms of distributions and collateral), and deeper liquidity in the underlying shares. For options traders, the practical implications are significant: better liquidity often translates into tighter bid-ask spreads, more reliable premium pricing, and a broader set of strike prices and expiration dates. The result is a more efficient market for selling covered calls, writing cash-secured puts, or layering protective options around a core long position.

In practice, investors who hold spot ETFs with options can implement strategies that are familiar to stock-option investors while being tailored to Bitcoin’s distinctive volatility profile. The convergence of traditional option markets with Bitcoin exposure represents a bridge between conventional portfolio construction and the now-common sense that crypto assets can provide meaningful diversification and high-return potential in the context of a properly managed risk framework.

Options on Bitcoin ETFs: Mechanics, Availability, and How to Navigate

Options trading on Bitcoin ETFs represents a relatively new but rapidly expanding area of opportunity. For those who are already familiar with the options markets for equities or other asset classes, Bitcoin ETF options function in a very familiar way: a purchaser buys the right, but not the obligation, to buy (call) or sell (put) the ETF at a predetermined price (the strike) on or before a certain date (the expiration). The seller receives a premium in exchange for taking on the obligation to fulfill the contract if the buyer exercises.

Key mechanics to note:

-

Delegated liquidity and clearing: Options on spot ETFs depend on robust liquidity in the underlying ETF and the option’s own market depth. The most liquid spot ETFs tend to have more liquid options markets, which translates into narrower spreads and more reliable premium values.

-

Strike selection and expiration: As with equity options, traders can select strikes above or below the current price, and they can choose monthly or longer-dated expirations depending on the product and broker capabilities. In practice, this provides a versatile menu for tailoring income objectives and risk tolerances.

-

Premium dynamics: The price of option premiums is driven by several variables, including the ETF’s current price, expected volatility of the ETF’s underlying Bitcoin exposure, time to expiration, interest rates, and the anticipated distribution or carry costs. In general, higher implied volatility (which Bitcoin often exhibits) tends to elevate option premiums, creating higher potential income for sellers.

-

Risks and trade-offs: Selling calls against a Bitcoin ETF (a covered-call approach) provides premium income but caps upside at the strike price. If Bitcoin surges beyond the strike price, the trader will likely be obligated to sell the ETF at the strike, potentially foregoing part of the upside. However, the premium earned reduces the net cost basis and can still yield attractive overall returns, especially when combined with roll strategies.

Here is a practical breakdown of the current landscape:

-

Spot ETFs with listed options:

- IBIT — Options available

- FBTC — Options available

- BITB — Options available

- HODL — Options available

- ARKB — Options available

-

Futures-based ETFs with options:

- BITO — Options available (historically liquid, first-mover in futures space)

- XBTF — Options available but with limited liquidity in some brokerages; availability can depend on the trading venue

This breakdown illustrates how traders can plan around liquidity and product type. The practical implication is simple: if you want to implement a covered-call strategy on Bitcoin exposure, spot ETFs with actively traded options tend to offer the most reliable and consistent trading conditions. Futures-based ETFs can also serve as a vehicle for options strategies, but you may encounter more limited liquidity in certain strike-expiration combinations.

A Simple Framework for Beginning with Options on Bitcoin ETFs

-

Step 1: Choose the ETF. Start with a widely traded spot ETF like IBIT or FBTC if you’re primarily seeking direct Bitcoin exposure with liquid options.

-

Step 2: Assess the options market. Look for ETFs with clear, liquid option chains and a range of strike prices that align with your risk tolerance and income targets.

-

Step 3: Define your objective. Decide whether you want income to offset carrying costs, or you want a more aggressive scheme that captures upside while selling calls that are closer to your strike.

-

Step 4: Implement a rotation plan. If you sell a call, consider rolling to a higher strike if the price approaches the strike, while adjusting expiration to manage risk and premium intake.

-

Step 5: Manage risk. Always have a plan for assignment risk, drawdown protections, and capital requirements. Use risk controls as you would with any options strategy.

-

Step 6: Monitor and adjust. Bitcoin ETF and options markets can react quickly to headlines, macro news, and sector-specific developments. Regular reviews of exposure, premium income, and realized P&L are essential.

These steps are not a forecast, but a practical blueprint for a disciplined approach to trading options on Bitcoin ETFs. They can help you avoid common missteps and align your day-to-day trading with a longer-term view of Bitcoin’s role in a diversified portfolio.

The Covered-Call Playbook: Turning Volatility into Consistent Cash Flow on Bitcoin Exposure

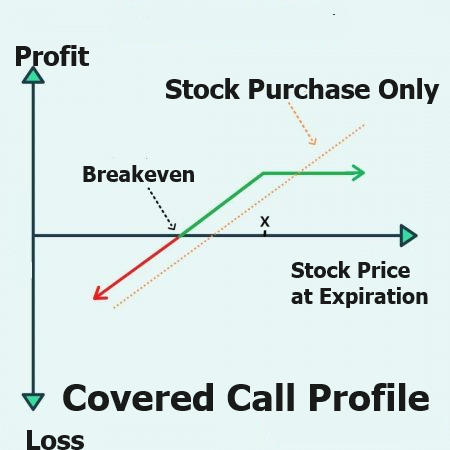

The core idea behind selling covered calls on Bitcoin ETF shares is to monetize the asset’s volatility rather than simply hoping for price appreciation. Think of Bitcoin as a property with a variable rent stream: when price swings are large, the premiums for options tend to rise, turning volatility into a predictable income source.

Here’s how the concept translates into a practical strategy on an ETF such as IBIT:

-

Long exposure to Bitcoin via IBIT: You own the ETF, which tracks the price of Bitcoin through the ETF’s structure and portfolio holdings. You retain exposure to upside if Bitcoin rallies, but you’re focused on cash flow generation primarily through option premiums.

-

Sell a call option against IBIT: You grant someone the right to buy IBIT from you at a fixed price (the strike) within a predetermined period (the expiration). In return, you receive an upfront premium.

-

Rich premiums in volatile markets: Because Bitcoin’s price has historically shown high volatility, the implied volatility priced into options tends to be elevated. This translates to larger premiums for calls, which is attractive to income-focused traders.

-

The premium as a buffer: The premium collected becomes a buffer against drawdowns, effectively lowering the net cost basis of your IBIT exposure. For example, selling a call that pays a premium of 4% to 6% per month can materially reduce the net cost basis over time.

-

Break-even and upside considerations: If the ETF remains flat or falls slightly, you keep the premium and the ETF shares. If the price rises but remains below the strike, you retain both the premium and the ETF exposure. If the price pierces the strike, you may be obligated to sell at the strike price, but you also capture the premium and, in many cases, a portion of the price appreciation up to the strike.

-

Risk management: The primary risk is assignment — being forced to sell the ETF if it trades above the strike at expiration. Beyond that, the standard market risk applies: the ETF’s price can fall, and the premium provides only partial protection. The risk premium pay-off is a question of whether the premium earned offsets downside risk in the asset.

The risk-reward profile of this approach is nuanced. On the one hand, you can generate meaningful monthly income from option premiums in a market characterized by frequent price swings. On the other hand, you trade away the potential for unlimited upside by capping gains at the strike price. The strategy is most attractive in markets where Bitcoin’s price is expected to rise long-term but is prone to near-term volatility or consolidation. In those environments, the premium collected through selling calls offers consistent cash flow while you maintain ownership of the asset.

A practical way to visualize this: consider a hypothetical example where IBIT trades around 65. You decide to sell a 70 strike call with a premium of 5. That premium immediately reduces your net cost basis from 65 to 60. If the price remains below 70 at expiration, you retain the premium and the ETF. If the price ends above 70, you realize a sale at 70 plus you keep the premium, effectively delivering a total return on your capital equal to the strike price plus the premium minus your lowered cost basis. If the ETF dips to 60 or lower, you still have the premium as a cushion, reducing the impact of the drawdown.

Seasoned traders approach covered calls as a method to harvest volatility rather than to chase dramatic price moves. It’s an income-focused strategy that remains compatible with a longer-term bullish view on Bitcoin, provided you are comfortable with the trade-off between upside potential and income certainty. The longer you stay within a disciplined framework—selecting strikes strategically, rolling the position, and managing risk— the more predictable the income stream becomes.

The Real-World Logic of Premiums and Drawdown Management

One of the most compelling aspects of this strategy is the “buffer” effect premium income creates. The premium cushions adverse moves in the ETF price, and it also funds a portion of your cost basis over time. The premium acts as a cushion and as a lever: it can allow for a lower average cost per share over many trades, and it provides a path to better risk-adjusted returns than simply holding and waiting for Bitcoin to appreciate.

The logic can be summarized as follows:

-

If Bitcoin is volatile and the ETF remains range-bound, premiums stay rich, delivering a steady stream of cash flow.

-

If Bitcoin rallies beyond the strike, you still realize a profit: premium plus the price appreciation up to the strike, albeit capped.

-

If Bitcoin declines, the premium reduces the realized loss relative to the downside, providing a partial hedge against drawdowns.

-

The strategy thrives in markets where volatility remains high or blips upward, because option premiums capture much of that movement in advance.

This logic is not a guarantee of profit, but it is a framework that aligns with a particular risk tolerance: you are willing to trade some upside for steadier cash flow and capital preservation, especially in an asset class as volatile as Bitcoin.

The Growth Narrative: Bitcoin’s Exponential Growth, Volatility, and the Cash-Flow Opportunity

Bitcoin’s long-run growth story has been startling, and it remains a central driver behind the appeal of income-generating strategies such as covered calls. An oft-cited figure is the historical annualized growth rate since inception, which, in aggregate, has hovered around the 50% mark. This is not a steady, guaranteed return, and it reflects the extraordinary compounding power of a new technology-driven financial instrument in its early stages of adoption. The forecast forward for Bitcoin, based on a range of market analyses, models, and expert projections, has often pointed toward an annualized return in the high single to low double digits or higher, depending on the scenario, with many buy-side assessments suggesting the possibility of roughly 29% annualized growth over the near-to-mid term in a favorable macro environment.

Let’s be clear: these aren’t “guaranteed” returns, and they come with a price tag in the form of heightened volatility. The volatility that makes Bitcoin attractive to option sellers is also the volatility that makes risk management essential. The upside potential for Bitcoin has historically been dramatic, but the downside risk has been unforgiving at times. The interplay between growth and volatility is what creates premium-rich option markets. When price swings are pronounced, option sellers are handsomely compensated for bearing the risk of a price move. When volatility cools, premiums compress, and income from selling calls can shrink. The math of this dynamic is not just about “income” in isolation—it’s about how that income interacts with price movements, time decay, and risk exposure to the underlying asset.

The bullish argument rests on the premise that a long-term, value-driven view of Bitcoin remains intact even in the face of headline-driven volatility. The compound-growth story hinges on adoption, network effects, institutional participation, and the continued evolution of the Web3 and decentralized finance ecosystems. Against that backdrop, earning rent on the Bitcoin exposure becomes a way to participate in the asset’s growth while feeling a measure of protection against the wildest swings.

Nevertheless, the upside does not come without chaos. The same volatility that fuels option premiums can shock the market, temporarily erasing gains or turning portfolio performance negative in the short run. This is not a contradiction; it is a natural feature of a volatile asset class with a relatively short, high-velocity history of price discovery. Traders who understand this will appreciate that the wealth-building potential of Bitcoin is not a smooth, linear ascent, but a path with dramatic inflection points that can be monetized through skillful trading methodologies like covered calls.

Big Returns Require Embracing Big Volatility

The fundamental logic here is straightforward: big returns in Bitcoin often come with big volatility. If you want the possibility of outsized gains, you must also be prepared for sharp drawdowns and abrupt regime shifts. The key is to use volatility, not try to suppress it, and to structure strategies that harness premium income while preserving exposure to the asset’s long-term appreciation. When you combine the risk and return dynamics with a disciplined covered-call approach, you are not merely speculating on price direction—you’re building a framework that can generate cash flow across different market regimes.

This perspective helps explain why professional traders often treat volatility as a resource rather than a hazard. The volatility premium is the fuel for options markets, and for income-focused strategies, it can be the central engine that sustains performance over extended periods. The long-run math may be complex, but the practical implications are clear: when volatility is high and movement is unpredictable, selling calls can offer a compelling way to monetize exposure while maintaining optionality for future upside.

The Anatomy of a Covered Call: A Practical Walk-Through on IBIT

To demonstrate the mechanics in concrete terms, let’s walk through a typical covered-call setup using a widely traded Bitcoin ETF such as IBIT (iShares Bitcoin Trust). The steps illustrate how an investor can turn price volatility into a consistent revenue stream.

-

Step 1: Own the ETF. The investor holds IBIT on a long-term basis, maintaining exposure to Bitcoin through the ETF’s holdings and structure.

-

Step 2: Sell a call against the ETF. The investor sells a call option with a chosen strike price and expiration date. The seller collects the option premium immediately, which becomes income and can offset the cost basis or be used to reinvest.

-

Step 3: Evaluate outcomes at expiration:

- If IBIT stays below the strike: the call expires worthless, the seller keeps the premium, and continues to own IBIT. The strategy can be repeated in the next cycle.

- If IBIT finishes at or above the strike: the ETF is likely sold at the strike price, and the seller keeps the premium. The seller still benefits from any price appreciation up to the strike and can repurchase IBIT or roll into a new position at a higher strike price for the next cycle.

- If IBIT moves sharply higher: the upside is capped at the strike price, but the premium collected up front helps offset the opportunity cost of selling at the strike.

-

Step 4: Reinvest and rotate. Seasoned traders will often “roll” the position by selling another call at a higher strike after expiration if the market is still favorable. Rolling is a way to maintain exposure to Bitcoin while continuing to collect premiums, rather than letting one cycle dictate the entire outcome.

-

Step 5: Assess risk and flexibility. The covered-call approach is designed to deliver steady income with capital preservation in mind. It’s not a guarantee of gains and can limit upside if Bitcoin experiences a dramatic upside move beyond the strike. It is, however, a disciplined framework for harvesting volatility, which is the lifeblood of option premiums.

The practical value of this approach is clear: it provides a method to monetize a Bitcoin ETF position by collecting regular premiums, with a defined risk profile and a repeatable process. The more volatile Bitcoin is, the more robust the premium potential tends to be, which makes covered calls particularly attractive during periods of heightened market turbulence.

The Buffer Effect and Premium Mechanics

A central idea in the covered-call approach is the concept of a buffer created by the option premium. In the simplest terms, the premium reduces the effective cost basis of the position and provides a cushion against short-term price declines. If you sell a call that pays a certain premium, you can think of the premium as a form of optional income that you collect regardless of whether Bitcoin moves. If the price remains flat or declines, you still keep the premium, which helps offset the loss in the ETF’s price. If Bitcoin rallies, you still enjoy some upside, but your gains are capped at the strike price plus the premium.

Traders often observe that the most attractive premiums arise when implied volatility is elevated. This tends to occur in markets where there is increased uncertainty or upcoming catalysts that might drive larger price swings. In those scenarios, selling calls provides the opportunity to capture premium while maintaining exposure to Bitcoin for the next leg of the journey. The strategy’s attractiveness rests on its ability to deliver cash flow when the price is not moving smoothly upward and to allow reinvestment or repositioning when the market provides a new set of opportunities.

A practical note on execution: the choice of strike price and expiration is critical. A strike chosen too close to the current price can result in a higher likelihood of being “called away,” which might be desirable if you want to realize gains and lock in profits, but may limit further upside. A strike set far above the current price reduces the probability of assignment but also yields smaller premiums. The optimization lies in balancing probability of assignment with premium income, all while preserving a long-term bullish thesis on Bitcoin.

The Market Dynamics: Why Bitcoin’s Nature Favors This Income Strategy

Bitcoin’s price history is characterized by long stretches of consolidation and sharp spikes rather than a steady, consistent appreciation. This behavioral pattern—alternating periods of sideways movement with sudden price bursts—means that the asset provides frequent signals for implied volatility to stay elevated. For income-oriented traders, that volatility translates into richer premiums, which form the core of the covered-call strategy’s cash-flow potential.

In practice, the reality is that much of Bitcoin’s trading life is not a straight ascent. Bearish or sideways conditions have historically occupied a sizable portion of its timeline. This observation matters for covered-call traders because it implies more frequent windows where selling calls yields meaningful income relative to the risk of assignment. When markets are calm, volatility tends to fade and premiums compress. When volatility is high, premiums rise and can sustain an income stream even when price action is not decisively directional.

This dynamic also underscores a broader point: the strategy is not about predicting the exact path of Bitcoin with precision. It’s about leveraging the structure of the market—its volatility and its tendency to present whipsaws—in a way that consistently produces cash flow. Over time, a disciplined approach to selling calls against a Bitcoin ETF can yield a predictable income stream that complements long-term ownership, providing a durable mechanism for portfolio growth independent of speculative calls or risky bets on whether a rally will occur.

The Trader’s Toolkit: AI, Trends, and Systematic Execution

In modern practice, many traders couple a covered-call approach with trend-detection tools and artificial intelligence to improve the odds of success. Some traders leverage AI-driven forecasting systems to identify potential trend reversals or confirm persistent trends before they commit capital to a covered-call position. The intention is not to replace human judgment but to provide a disciplined signal stream that helps define the optimal windows for selling calls, and when to roll or adjust positions.

In the context of Bitcoin ETFs, AI can help in several ways:

- Trend identification: To determine whether Bitcoin’s price environment favors selling calls, holding long exposure, or adjusting positions.

- Volatility forecasting: To anticipate periods of high implied volatility, which tend to yield richer option premiums.

- Risk control: To quantify the risk-reward profile of different strike-expiration combinations and help implement a consistent risk-management framework.

Crucially, AI is a tool. It provides insights, not guarantees. The most resilient strategies use AI as a complementary input to a structured, rules-based process, with explicit risk controls and regular reviews of performance and assumptions.

Practical Implementation: A Step-by-Step Roadmap to Start

If you’re ready to explore selling covered calls on Bitcoin ETFs, here is a practical roadmap that aligns with the disciplined approach described above:

-

Step 1: Establish your Bitcoin exposure with a spot ETF. Start with a well-traded fund like IBIT or FBTC to ensure strong liquidity for both the underlying asset and the options market.

-

Step 2: Verify the options chain. Confirm that the ETF has a liquid options market with a broad range of strikes and expiration dates. This is critical to achieving the best risk-adjusted returns.

-

Step 3: Set a clear income objective. Decide how much monthly premium income you want relative to your position size, and how much downside you’re willing to bear.

-

Step 4: Choose strikes and expirations strategically. For a first trade, pick a strike moderately above the current price and a monthly expiration to establish a baseline. Use this as a learning exercise to refine risk controls and premium targets.

-

Step 5: Execute the trade and collect the premium. You sell the call and immediately receive the premium. Confirm your broker’s reporting and ensure you understand the tax implications relevant to your jurisdiction.

-

Step 6: Monitor and manage risk. Track the ETF price relative to the strike and be prepared to roll or adjust if market conditions change. If assignment occurs, evaluate whether to repurchase or to switch to a higher strike for the next cycle.

-

Step 7: Reinvest and compound. As you collect premiums, reinvest the income and consider adjusting the strategy to incorporate longer-dated options, different strike levels, or alternate ETFs with stronger liquidity profiles.

-

Step 8: Review performance and refine. Periodically assess realized gains, premium income, and any assignment events. Use your findings to optimize strike choices, expiration timing, and risk controls.

This roadmap emphasizes depth, discipline, and a systematic approach to turning Bitcoin’s volatility into an income-generating strategy. It’s about building a repeatable process rather than chasing a single, high-risk payoff.

The Ethical and Risk Considerations: Safety, Capital, and Responsible Trading

No discussion of trading strategies would be complete without a sober reminder about risk. Trading Bitcoin ETFs and their options involves substantial risk of loss, and it is not suitable for all investors. The underlying market is volatile, and the liquidity of options can vary based on market conditions and broker platforms. Any strategy that relies on volatility for income must include robust risk management practices, including:

- Only risk capital: Use funds you can afford to lose.

- Diversification: Do not concentrate your entire portfolio on a single asset or strategy.

- Clear risk controls: Define maximum drawdown levels and stop criteria for each trade.

- Regular reviews: Monitor performance, assumptions, and risks on a consistent schedule.

- Tax considerations: Understand how profits and premiums are taxed in your jurisdiction.

The risk disclosures are essential in any financial decision. The aim here is to provide a blueprint for understanding how a covered-call strategy on Bitcoin ETFs can work within a disciplined framework, not to promise profits or to guarantee successful outcomes.

The Broader Market Context: Maturity, Adoption, and the Road Ahead

The Bitcoin market has matured significantly since its early days. Institutions are now players on a wider stage, and the options markets have grown in sophistication and breadth. Retail traders increasingly have access to instruments previously reserved for large institutions, including spot Bitcoin ETFs and the corresponding options markets. This maturation has a feedback effect: liquidity improves, which in turn enables more robust strategies. For traders, this means more reliable premium pricing, more robust risk management tools, and the opportunity to construct diversified, income-oriented portfolios anchored by Bitcoin exposure.

From a macro perspective, Bitcoin’s role in portfolio construction is evolving. It’s increasingly viewed as a potential store of value, a hedge against inflation, and a high-growth option within a diversified investment plan. The availability of options on ETFs that hold actual Bitcoin supports a broader set of use cases: income generation, risk management, capital allocation efficiency, and strategic asset allocation. The confluence of these factors makes the Bitcoin ETF and options landscape a compelling field for readers who want to understand how to combine volatility, risk management, and income generation into a cohesive strategy.

As the market continues to develop, expect more ETF issuers to refine product design, minimize costs, and expand the availability of options across a wider array of Bitcoin-linked funds. This ongoing evolution will likely yield deeper liquidity, better price discovery, and more robust risk-reward opportunities for both professional and retail traders alike.

The AI-Driven Edge: Artificial Intelligence, Trend Forecasting, and Practical Advantage

A recurring theme in modern trading is the use of artificial intelligence to inform trading decisions. In the world of Bitcoin ETFs and options, AI-based trend forecasting and risk assessment can complement traditional technical analysis and fundamental view. The idea is to use advanced analytics to identify the likely direction or consolidation phase for Bitcoin’s price, optimize entry and exit points for covered calls, and calibrate risk controls in real time. The key is to avoid overreliance: AI is a powerful tool, not a crystal ball. When integrated with a disciplined framework for selling calls and rolling positions, AI can help traders stay ahead of changing market regimes and adjust to shifts in volatility.

The practical application of AI in this context can include:

- Short- to mid-term trend forecasts that inform whether to maintain an uncovered position, to sell a call, or to adjust strike levels.

- Volatility modeling to estimate premium potential and to time entries and exits with greater precision.

- Scenario analysis and stress testing to gauge how the strategy would perform under adverse conditions or unexpected shocks.

- Automation of routine tasks and risk controls, allowing traders to scale their approach without compromising discipline.

Educating readers about the AI edge helps reconcile traditional trading wisdom with modern tools. It’s not about outsourcing judgment, but about augmenting the trader’s decision process with data-driven insights and probabilistic thinking.

Important caveat: AI can improve outcomes but does not guarantee profits. Markets can deviate from forecasted paths for extended periods, and active risk management remains essential.

The Bottom Line: A Strategy Rooted in Discipline, Designed for Durability

In a market obsessed with narratives and moonshots, selling call options on Bitcoin ETFs offers something rare: a path to predictable income derived from volatility itself. It’s not about outguessing the next spike in Bitcoin’s price. It’s about fundamentally understanding market structure, leveraging volatility as a revenue source, and accepting a deliberate trade-off: the possibility of unlimited upside is exchanged for controlled, tangible returns and capital preservation.

Over the long arc of Bitcoin’s evolution—from a niche experiment to a potential institutional asset—volatility has always been a defining characteristic. The question isn’t whether volatility exists; it’s whether you are prepared to use it as a strategic advantage. The covered-call approach—applied to a Bitcoin ETF such as IBIT or FBTC—offers a disciplined framework for harvesting the premium embedded in volatility while preserving exposure to the asset’s growth trajectory.

In the end, the choice to implement a covered-call strategy on Bitcoin ETFs comes down to a few core principles:

- Consistency over heroics: Build a repeatable process that generates cash flow across different market regimes.

- Risk-aware capital allocation: Respect the risk of assignment and the potential for drawdowns, and tailor your strategy to your risk tolerance and time horizon.

- Strategic use of premium income: Let option premiums offset carrying costs, reduce effective cost basis, and enable reinvestment for compounding growth.

- Commitment to ongoing learning: Adopt a data-informed approach, incorporating trend analysis, volatility insights, and efficient risk controls.

If you embrace these principles, you may find that Bitcoin’s volatility becomes less a source of fear and more a reliable engine for income. Covered calls offer a practical, accessible way to participate in the Bitcoin narrative while maintaining a prudent risk posture. And as the market continues to mature, this approach stands to benefit from greater liquidity, more sophisticated products, and a broader ecosystem of participants who view Bitcoin as an asset class with enduring value.

Conclusion

The Bitcoin ETF and options ecosystem has matured into a robust framework for turning volatility into steady income. Spot ETFs with actively traded options provide a practical vehicle for gaining direct exposure to Bitcoin while leveraging the income-generation potential of covered-call strategies. The growth narrative—rooted in historic performance and supported by forward-looking forecasts—continues to attract sophisticated participants seeking to monetize volatility rather than merely chase price appreciation.

A disciplined, methodical approach to selling calls against Bitcoin ETF exposure can deliver a durable cash flow, with risk management at the core of the strategy. This is a powerful reminder that modern markets reward not only directional bets but also the intelligent use of market structure to extract value from volatility. As adoption grows and the options landscape broadens, traders who combine a long-term bullish view of Bitcoin with income-focused execution stand to enhance risk-adjusted returns, preserve capital, and navigate a volatile but increasingly accessible market.

This framework—built on an explicit strategy, supported by data-driven risk controls, and executed with careful attention to liquidity and costs—offers a practical path for investors who want to participate in Bitcoin’s long-term upside while earning rent on their exposure today. The road ahead for Bitcoin options trading is bright, but it remains essential to stay disciplined, monitor the environment, and continually adjust as market dynamics evolve. The strategy is not a shortcut to riches; it is a deliberate, repeatable process designed to endure.

Important risk note: Trading stocks, futures, options, ETFs, and currencies involves substantial risk. Only risk capital should be used, and you must be fully aware of the risks and willing to accept them. This article is not a solicitation or an offer to buy or sell any securities. Past performance is not indicative of future results. Use caution and seek professional advice as appropriate.